Classifying the characteristics of insurance shares: a k-means clustering approach

Abstract

Keywords

Full Text:

PDFReferences

Y. Utami, “Indeks Saham Syariah Indonesia: Pergerakan Harga dari Perspektif Asimetri

Informasi,” J. Inov. Ekon., vol. 4, no. 02, pp. 41–48, 2019, doi: 10.22219/jiko.v4i2.9851.

B. Widagdo and N. R. Satiti, “Indonesian Capital Market Reaction Toward November, 4th

Demonstration in Jakarta,” J. Innov. Bus. Econ., vol. 2, no. 01, pp. 29–36, Dec. 2018, doi:

22219/JIBE.V2I01.5561.

I. Zuhroh, M. Rofik, and A. Echchabi, “Banking stock price movement and macroeconomic

indicators: k-means clustering approach,” http://www.editorialmanager.com/cogentbusiness, vol. 8, no.

, 2021, doi: 10.1080/23311975.2021.1980247.

R. Nilavongse, M. Rubaszek, and G. S. Uddin, “Economic policy uncertainty shocks, economic

activity, and exchange rate adjustments,” Econ. Lett., vol. 186, Jan. 2020, doi:

1016/j.econlet.2019.108765.

A. S. Yang and A. Pangastuti, “Stock market efficiency and liquidity: The Indonesia Stock

Exchange merger,” Res. Int. Bus. Financ., vol. 36, pp. 28–40, Jan. 2016, doi:

1016/J.RIBAF.2015.09.002.

K. Lim and C. Hooy, “The delay of stock price adjustment to information: A country-level

analysis,” Econ. Bull., vol. 30, no. 2, pp. 1609–1616, 2010, Accessed: Dec. 07, 2022. [Online].

Available: https://ideas.repec.org/a/ebl/ecbull/eb-10-00033.html

H. P. Kriegel, E. Schubert, and A. Zimek, “The (black) art of runtime evaluation,” Knowl. Inf.

Syst., vol. 52, no. 2, pp. 341–378, Aug. 2017, doi: 10.1007/S10115-016-1004-2.

A. Likas, N. Vlassis, and J. J. Verbeek, “The global k-means clustering algorithm,” Pattern

Recognit., vol. 36, no. 2, pp. 451–461, Feb. 2003, doi: 10.1016/S0031-3203(02)00060-2.

A. K. Jain, “Data clustering: 50 years beyond K-means,” Pattern Recognit. Lett., vol. 31, no. 8, pp.

–666, Jun. 2010, doi: 10.1016/J.PATREC.2009.09.011.

DOI: http://dx.doi.org/10.26555/jifo.v15i3.a23372

Refbacks

- There are currently no refbacks.

Copyright (c) 2022 Y Utami, I Zuhroh, V Prasetya, Mochamad Rofik

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

____________________________________

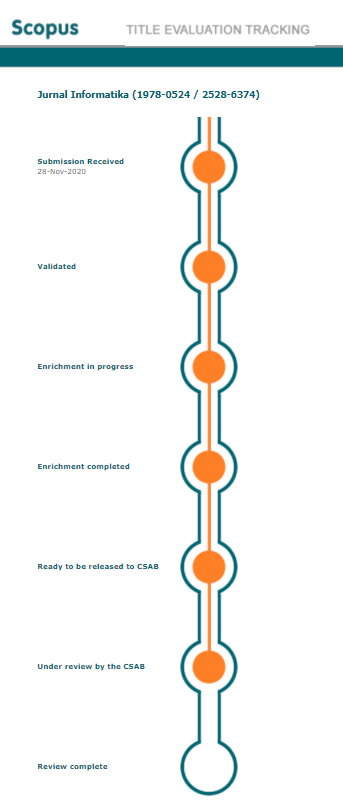

JURNAL INFORMATIKA

ISSN :Â 1978-0524 (print) | 2528-6374 (online)

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.